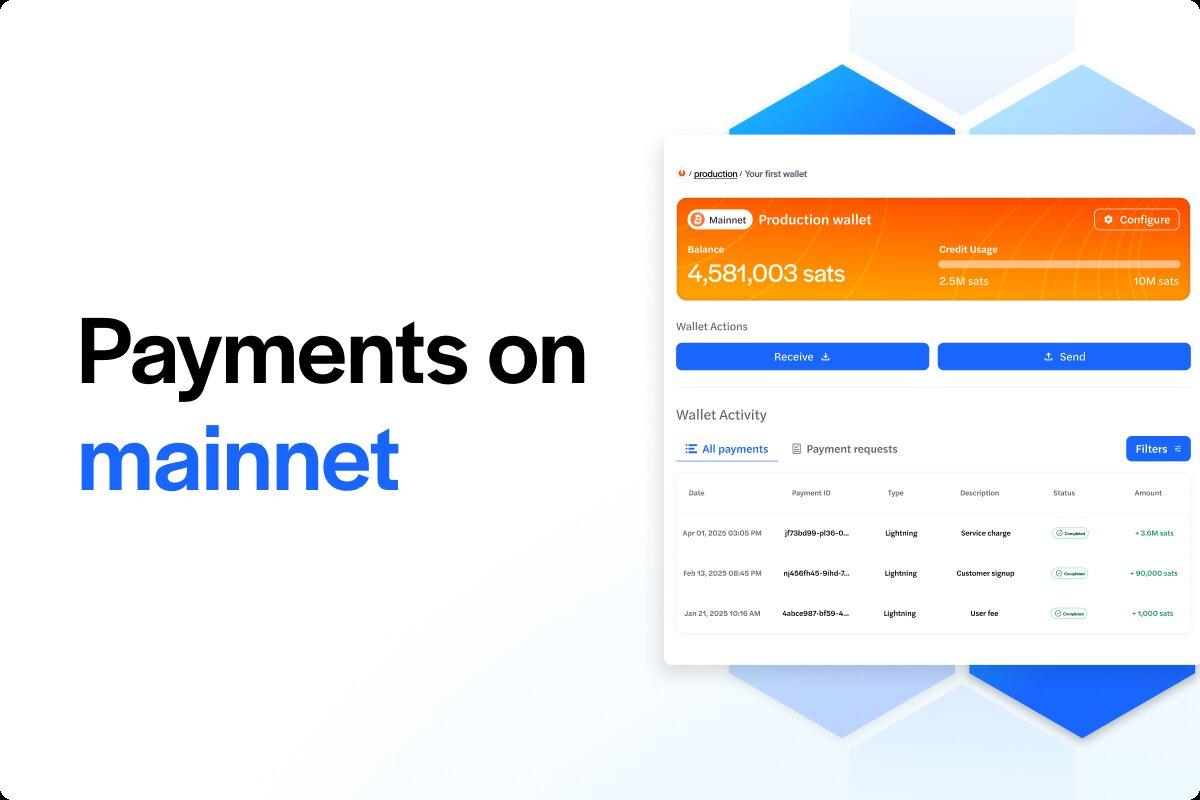

Voltage Payments on Mainnet: Credit Backed Lightning Payments Are Live

Voltage Payments is now live on mainnet, and eliminates the need for businesses to pre-fund or manage their own Lightning Network liquidity by offering a credit-based model that enables instant Bitcoin transactions. Companies can now move money at internet speed, settling in USD or BTC later, freeing up capital, reducing operational overhead, and accelerating product launches through a simple API-driven payments platform.

Many businesses exploring Bitcoin and the Lightning Network have run into the same challenge: liquidity. To send or receive payments, companies have traditionally had to pre-fund accounts, lock up capital in channels, and dedicate teams to ongoing liquidity management. This approach creates operational overhead and leaves millions of dollars sitting idle.

Voltage Payments changes this model. Now live on mainnet, we enable exchanges, neobanks, lenders, and fintechs to transact instantly over the Lightning Network without pre-funding liquidity or maintaining complex infrastructure.

Instead, businesses use a line of credit from us, settling in USD or BTC at the end of each billing cycle. It’s modeled on the same type of credit enterprises already understand and use, now applied to the fastest payment network in the world.

Why This Matters

Payments should be as fast as the internet. With Voltage Payments, they finally are, and without the hidden costs that have slowed enterprise adoption. This model preserves capital, strips out operational headaches, and gives teams the ability to ship new products in days, not quarters.

Key Benefits

- Capital Efficiency – No more idle liquidity. Credit is drawn only when needed, so working capital is maximized.

- Faster Launches – Deploy Lightning payments in days through a simple API and dashboard.

- Multi Asset Support – Send and receive both Bitcoin and soon stablecoins on one platform.

- Fiat Settlement – Settle invoices in USD to protect balance sheets from volatility.

- Enterprise Grade Controls – Role based permissions, compliance tools, and unified visibility for teams.

Who Benefits

- Finance leaders keep free up cash for growth, settle in USD, and avoid tying balance sheets to Bitcoin.

- Engineering teams skip node operations and liquidity playbooks, integrating with simple APIs instead.

- Product leaders can finally ship instant deposits, withdrawals, and global payouts without compromise.

What We Are Seeing Already

Early pilots with U.S. customers show faster payouts, lower operational costs, and more trust from end users who experience payments that work seamlessly. We are already onboarding exchanges, fintechs, and traditional financial firms, and now we are ready to bring more onto the network.

Looking Ahead

Voltage Payments is available today to qualified U.S. businesses, with phased global expansion planned through 2026. Lightning credit payments are a structural shift in how capital and payments work together.

Our belief is simple. The fastest payment network in the world should not require locking up liquidity. With Voltage Payments, businesses can finally move at Lightning speed without tying up precious working capital.

👉 Get a free strategy consultation for your business, or start using on mainnet today, register and begin now.

---

Notices and disclaimers:Voltage Payments is a product name for a secured commercial line of credit provided by Voltage Credit, LLC to qualified businesses. Voltage Credit, LLC operates exclusively as a secured lender under state lender licenses or exemptions from licensure. Voltage Credit, LLC does not engage in money transmission.All lines of credit are fully collateralized, except as may be otherwise specified or approved through the underwriting process.